Introduction

Secured loans are a cornerstone of borrowing, offering both lenders and borrowers a sense of security. In this comprehensive guide, we’ll delve into the intricate world of secured loans, demystifying the process, exploring various types, and shedding light on the nuances of collateral-backed borrowing.

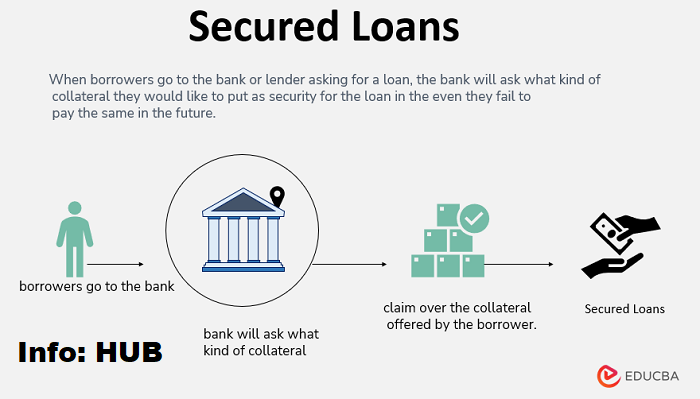

Defining Secured Loans

Secured loans are financial arrangements where borrowers pledge assets as collateral to secure the loan. This collateral provides lenders with a form of assurance, mitigating the risk of default.

Importance of Secured Loans

Secured loans play a vital role in facilitating borrowing for individuals and businesses. They provide access to funding that might otherwise be unavailable, fostering economic growth and financial stability.

Types and Categories

Secured loans come in various forms, tailored to meet diverse needs and circumstances.

Mortgage Loans

A mortgage is perhaps the most common type of secured loan, used to purchase real estate. The property serves as collateral, allowing individuals to access substantial amounts of funding for home purchases.

Auto Loans

Auto loans are secured by the vehicle being financed. Lenders retain the title until the loan is repaid, reducing the risk associated with lending for vehicle purchases.

Secured Personal Loans

These loans are backed by personal assets such as savings accounts, investments, or valuable possessions. While offering flexibility, they typically carry lower interest rates than unsecured alternatives.

Business Loans

Businesses can secure loans using assets such as equipment, inventory, or accounts receivable as collateral. These loans are crucial for funding growth initiatives or overcoming financial hurdles.

Symptoms and Signs

Understanding the characteristics of secured loans is essential for making informed borrowing decisions.

Requirement of Collateral

Unlike unsecured loans, secured loans necessitate collateral, which serves as a form of security for lenders.

Lower Interest Rates

Due to the reduced risk for lenders, secured loans often feature lower interest rates compared to unsecured counterparts.

Higher Borrowing Limits

Collateral-backed loans enable borrowers to access higher loan amounts, making them suitable for significant expenses such as property purchases or business investments.

Causes and Risk Factors

Various factors contribute to the prevalence and popularity of secured loans.

Economic Stability

A stable economic environment encourages lending institutions to offer secured loans, as they can confidently assess and manage associated risks.

Asset Ownership

The availability of assets such as real estate, vehicles, or savings accounts enables individuals to qualify for secured financing, expanding access to credit.

Regulatory Framework

Regulations governing lending practices influence the availability and terms of secured loans, ensuring responsible lending and consumer protection.

Diagnosis and Tests

Before committing to a secured loan, borrowers should conduct thorough assessments to determine suitability and affordability.

Financial Assessment

Evaluate personal or business finances to ascertain the ability to repay the loan, considering income, expenses, and existing debt obligations.

Collateral Valuation

Appraise the value of assets being used as collateral, ensuring they meet lender requirements and adequately secure the loan.

Credit Check

Lenders typically perform credit checks to assess the borrower’s creditworthiness, impacting loan approval and terms.

Treatment Options

Secured loans offer a range of options tailored to meet diverse financial needs and objectives.

Fixed-rate Loans

These loans feature a consistent interest rate throughout the repayment period, providing predictability and stability for budgeting purposes.

Adjustable-rate Loans

Adjustable-rate loans offer flexibility, with interest rates that fluctuate based on market conditions. While initially lower, they pose risks of payment increases in the future.

Home Equity Loans

Homeowners can leverage the equity in their property to secure loans, unlocking funds for home improvements, debt consolidation, or other purposes.

Preventive Measures

Responsible borrowing practices are essential for mitigating risks associated with secured loans.

Budgeting and Financial Planning

Develop a comprehensive budget and financial plan to manage income, expenses, and debt repayment effectively.

Asset Protection

Safeguard collateral assets by maintaining insurance coverage and implementing risk mitigation strategies to prevent loss or damage.

Timely Payments

Adhere to loan repayment schedules to avoid default and potential consequences such as asset seizure or credit damage.

Personal Stories or Case Studies

Real-life experiences offer valuable insights into the impact and implications of secured loans.

Jane’s Home Renovation Journey

Jane, a homeowner, utilized a home equity loan to finance renovations, increasing her property’s value and enhancing her living space. Despite initial apprehensions, she found the process straightforward and beneficial.

Mark’s Business Expansion Endeavor

Mark, a small business owner, secured a business loan using equipment as collateral to expand operations. The infusion of capital enabled him to increase production capacity and capture new market opportunities.

Expert Insights

Professional perspectives shed light on best practices and considerations when navigating secured borrowing.

Dr. Sarah Johnson, Financial Advisor

“Secured loans offer viable financing solutions for individuals and businesses, but careful assessment of terms and risks is crucial to ensure sustainable financial health.”

David Martinez, Loan Officer

“Collateral-backed loans provide lenders with added security, often resulting in more favorable terms for borrowers. However, it’s essential to understand the implications of default and asset forfeiture.”

Conclusion

Secured loans represent a cornerstone of borrowing, offering access to funding while mitigating risks for lenders and borrowers alike. By understanding the intricacies of collateral-backed borrowing, individuals and businesses can make informed financial decisions, unlocking opportunities for growth and prosperity.

FAQ

- What is a secured loan?

- A secured loan is a type of borrowing where the borrower pledges assets, such as property or vehicles, as collateral to secure the loan. This collateral provides assurance to the lender, reducing the risk of default.

- How does a secured loan differ from an unsecured loan?

- Unlike unsecured loans, which do not require collateral, secured loans necessitate the pledging of assets as security. This typically results in lower interest rates and higher borrowing limits for secured loans compared to unsecured alternatives.

- What types of assets can be used as collateral for secured loans?

- Various assets can serve as collateral for secured loans, including real estate (for mortgage loans), vehicles (for auto loans), savings accounts, investments, equipment, inventory, and accounts receivable (for business loans), among others.

- What are the benefits of secured loans?

- Secured loans offer several advantages, including lower interest rates, higher borrowing limits, and increased accessibility to funding, especially for individuals or businesses with valuable assets but limited credit history or income.

- What are the risks associated with secured loans?

- While secured loans provide benefits, they also carry risks, primarily related to the potential loss of collateral in the event of default. Borrowers must carefully assess their ability to repay the loan to avoid the risk of asset forfeiture.

- Can secured loans help improve credit scores?

- Responsible repayment of secured loans can positively impact credit scores by demonstrating the borrower’s ability to manage debt effectively. However, defaulting on secured loans can have adverse effects on creditworthiness.